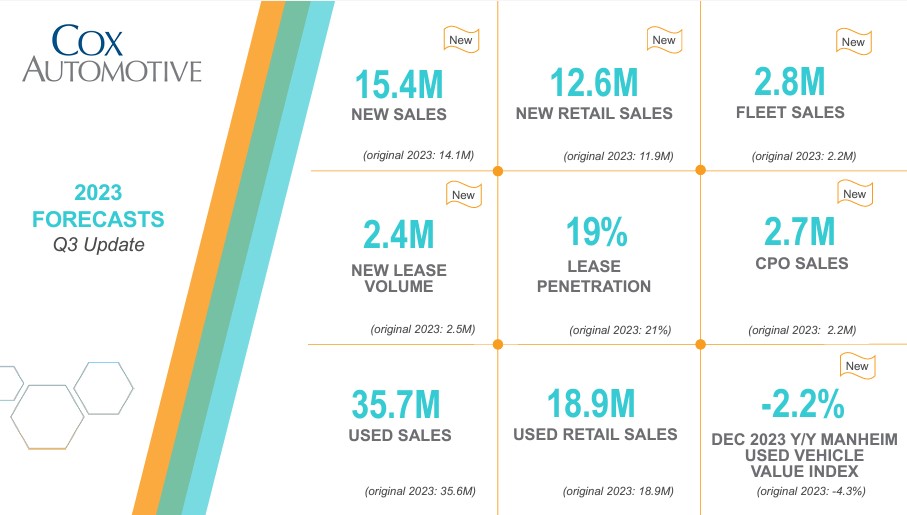

Used vehicle sales are expected to end the year at 35.7 million, according to a new forecast from Cox Automotive.

The forecast is up slightly from the 35.6 million predicted at the start of the year.

Cox Automotive presented the updated forecast during its Industry Insights and Sales Forecast Call Tuesday.

Used vehicle sales enjoyed a strong September, with rolling 30 days sales up 7 percent from the previous year, according to Cox Automotive.

“Used vehicle sales are having quite a moment,” said Chris Frey, Senior Manager, Economic and Industry Insights at Cox Automotive. “They’ve been bucking season trends since July.”

Used vehicle inventory is down 10 percent and the days of supply is at 44.4 days.

Sales are expected to soften in the third quarter due to the high interest rates, inventory and continued affordability issues.

The average listing price is down 5 percent year over year, but is still north of $26,000.

The average interest rate for used vehicle loans are at 14.03 percent.

“Affordability is near an all-time low,” said Jonathan Gregory, Senior Manager, Economic and Industry Insights at Cox Automotive. “Interest rates are the No. 1 issue holding back sales.”

The new forecast for certified pre-owned sales increased to 2.7 million from 2.2 million.

“We upgraded the CPO numbers. It shows the demand is there,” said Jonathan Smoke, Cox Automotive’s Chief Economist.

Smoke said inventory issues with the supply of certified pre-owned vehicles is the one thing that could hold the sector back in the final quarter of the year.