How Can You Help Customers See the Value in F&I Products? A Little Number Crunching Does the Trick.

One of the biggest challenges for any auto dealership is increasing gross profit per retail unit (PRU) through F&I product sales.

Ten percent of the population buys whatever product is put in front of them. Ten percent refuses all products regardless of any perceived value.

That leaves 80 percent who are at least willing to listen and negotiate.

Sometimes, though, it feels like 90 percent of consumers just don’t want to hear it. That is often because of a negative consumer mindset about the used vehicle industry as a whole.

Haven’t we all heard jokes about used car salesmen, or heard customers say vehicle service contracts are just a waste of money?

Our industry still faces an uphill battle when it comes to building consumer trust. And that’s especially true in the independent space.

Every customer wants to have the value of a product exceed the cost – that’s when those customers decide to make the decision to buy, and that’s what we’re trying to accomplish.

So positioning VSCs as value-add options is the goal. But how do you frame a cost-add item as a value-add opportunity?

Tackle that challenge and you will make strides in building trust when closing the deal.

The Benchmark Formula: Minimizing Cost With Benchmarks

When it comes to selling F&I products, the point is to sell as many as possible, not to sell them for as much as possible.

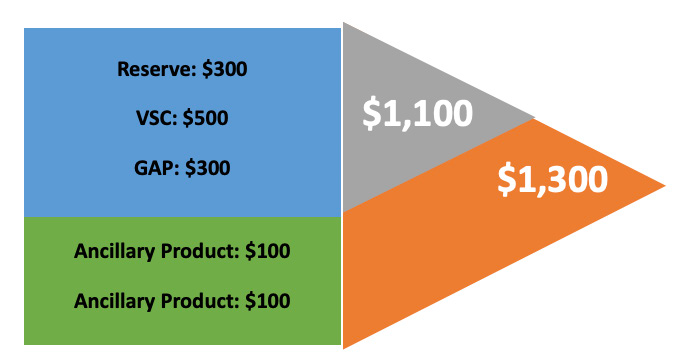

Dealers need to set achievable baseline benchmarks for PRU. For example, one dealership can set a minimum benchmark of $1,100 PRU – meaning every deal needs to hit that benchmark.

A smart way to achieve that is by combining a small reserve from an auto lender with the sale of a VSC and guaranteed asset protection (GAP).

The sale of those two products alone hits the benchmark. Add two ancillaryproducts on top of that and the dealer is sitting pretty.

By spreading out product sales and not focusing on the sale of only one or two products, your team doesn’t need to shop for the highest reserve possible, meaning they can provide customers with reasonable loan options.

In addition, it enables your dealership to price products more reasonably, which helps demonstrate product value and build trust.

That all spells happy customers, fewer refinances and less chargebacks. It also results in more repeat business and referrals.

Closing Formula: Building Trust

Closing a customer starts with the credit application and customer interview. That’s the time you can ask open-ended or probing questions that will enable you to discover buying motivations to better position product benefits during the product presentation and menu negotiations, while also building rapport.

A good example of an open-ended question is, “What put you in the market for a vehicle?” That’s one of the best questions you can ask to get the customer to open up and discuss everything you need to know while also bringing up common ground.

Don’t be shy about asking for employment information.

Break down the annual income to monthly and bi-weekly components. That will help verify the information you are gathering is correct for the credit application, and it will help with closing and overcoming objections.

Getting an understanding of how long a customer keeps his or her vehicle lets you know whether you can upsell to longer-term protection plans. And discovering whether a customer drives clients around, works in construction, is a student, has a long commute, lives in the country or in the city, allows you to find a way to tie the benefits of tire and wheel, dent and ding, maintenance, etc., to their individual experiences.

Get to know your customer as well as possible before you even begin presenting products. Then during the product presentation, you can bring up all those tidbits to create need, build personal value and get buy-in for the products.

Closing Formula: Minimizing Cost With Logic

Once you are done with the consumer protection product benefit discussion it’s time for the menu presentation.

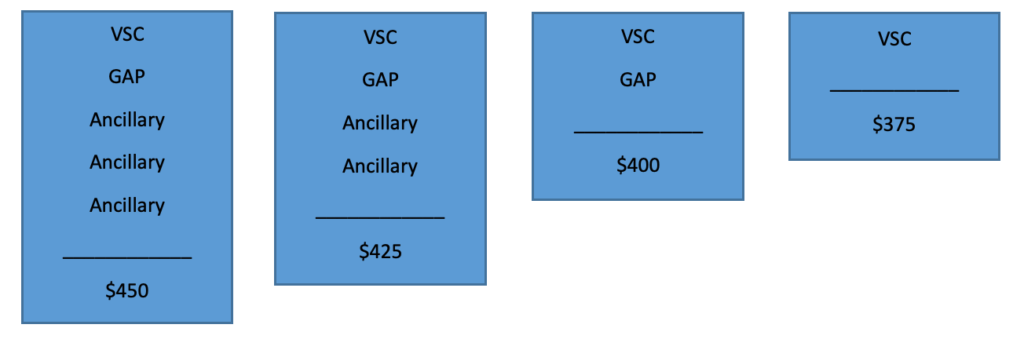

All menus should list the base monthly payment, term and interest rate. Most include at least a four-tier breakdown of product plans.

Once customers see how much their base payment could increase with the additional products, their most common objection is that they simply can’t afford that higher payment.

That’s completely understandable, but there are several ways you can reposition the numbers in a more positive light.

For the following closes, let’s assume we have a menu with a base payment of $350, and a breakdown as follows:

Paycheck close: Let’s say you’ve done a great job building the value of the products and the customer says she wants all the products in the first tier but can’t afford the $450 monthly payment.

Again, that’s understandable. But help them break down the difference between $350 and $450 – which, as we all know, is only $100.

You should already know the answer to how often she gets paid, but have her reiterate it by phrasing the question to get a yes or no answer. For example, “If I remember correctly, you get paid twice a month, right?”

Once she says yes, break down that $100 into $50 increments per paycheck and ask whether missing that $50 per paycheck would affect her ability to make monthly payments like rent, mortgage, cable, utilities, etc.

Again, it’s important to ask the question with the goal of getting the customer to say yes: “So if that $50 wasn’t in your paycheck on the 15th, you could still pay your mortgage, right?”

That helps customers gain perspective on the proposed monthly payment while also getting them in the habit of agreeing with you.

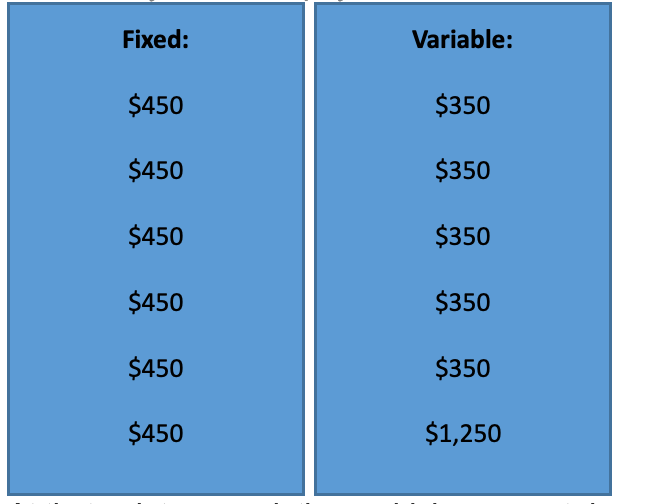

Fixed vs. variable close: This close reiterates product value and reminds customers of how their savings is protected from unforeseen life events, like a mechanical breakdown. However, you’ll need to do some background work.

Once a month, talk with a certified mechanic to see what the average cost of a vehicle repair is and take note of it.

With that number in mind, remind customers the likelihood of needing a repair with any preowned vehicle is greater than that of a new vehicle, regardless of how thoroughly inspected the used car is.

And remind them they will most likely need to come up with that cash on their own.

Then plot out six months of vehicle payments. In the fixed column, put the payment that includes F&I products. In the variable column, put the base payment of just financing the vehicle.

At the six-month mark of the variable column, add the average cost of a vehicle repair to the monthly auto loan payment.

At that point, you ask them which payment doesn’t affect their ability to manage their other monthly expenses or force them to dip into their savings.

This close is great for customers on very tight budgets. The average consumer has no idea how much actual repairs cost, and their estimate is far less than the actual cost.

Having those details from your service department provides useful information – and keeps you in the frame of trust. Ask your customer, “Which scenario is better for your budget – being prepared and having a minimal repair cost or not seeing large repair costs before they hit?”

Some customers might counter that they are getting a reliable car and they’ll take the chance. Others might say they know someone who can repair the vehicle for less.

Don’t despair. There’s still room to demonstrate to your customers that the benefits of the products provided outweigh that $100 a month cost.

“I’ll take the chance” objection: When a customer says he’ll take the chance, you don’t want to make the car seem unreliable – that could end up costing you the sale of the car.

Instead, remind customers that regardless of reliability, all cars break down. The best way to do that is to bring up the manufacturer’s warranty.

Remind the customer that you understand he is buying a very reliable car, but ask him, “Why does the vehicle’s manufacturer provide warranties on new vehicles when they are supposed to be even more reliable than preowned?”

The answer is because components break down. That means manufacturers are trying to protect their new vehicle buyers from unforeseeable and potentially exponential costs.

Ask the customer why he wouldn’t want the same protection for his pre-owned vehicle, which is more likely to break down.

Some customers might say they have the savings to cover a repair. That’s great.

But ask them which of these scenarios makes more sense for their budget.

A customer goes into a repair facility owing $25,000 on a vehicle and takes $1,000 out of savings to pay for the repair. But at the end of the day, the customer still owes $25,000.

But with consumer protection products, the customer can put that $1,000 of savings toward the auto loan payment to pay down the principal – and still get the vehicle repaired while owing less on the vehicle in the long term.

The second scenario makes more sense, right?

“I know someone” objection: When customers say they know someone, create a hypothetical situation.

Let’s say a customer asks her friend to provide towing assistance and a rental car, and to cover the cost of repairing a vehicle at any time, day or night. And the customer will pay her friend $100 a month for all those services.

Will the friend take that deal?

The answer would be no. So, once again, which makes more sense?

Closes are great, but the best way to overcome objections is by working the process, starting with the customer interview.

In all of the closes we’ve discussed, the point is to get customers to agree with you that the benefits they receive are well worth the increase to their monthly auto payment.

There should be no need to be confrontational or to make the customer feel pressured. The entire conversation should be relaxed and fairly short, respecting their time.

That’s why the initial interview is so important. It will dictate which close makes the most sense for the customer in front of you.

The closing algorithm is simple. It requires reasonable product pricing and penetration goals, active listening and relating product benefits to each individual experience.

It’s not rocket science – just good selling and good customer service.