Concerns about tariffs, trade and continued affordability challenges, with high prices and elevated interest rates, have complicated the used vehicle market in 2025.

Uncertainty will remain part of the puzzle moving into the second half of the year, said NIADA Director of Education Brent Carmichael and Senior Director of Economic Industry Insights at Cox Automotive Mark Strand during their industry update at the NIADA Convention and Expo.

“Uncertainty is the only certainty. I talked about the tariffs and the One Big Beautiful Bill. We don’t know where those will land, and it’s highly possible we don’t know until September,” Strand said. “We’ve just got to be mentally prepared. As long as the metrics in the economy are holding up, people are going to continue to buy cars…We’ve got to stay lean, source creatively and stay efficient.”

Though there is uncertainty, Strand and Carmichael pointed out, “the sky is not falling,” and opportunity remains for the resilient independent dealer.

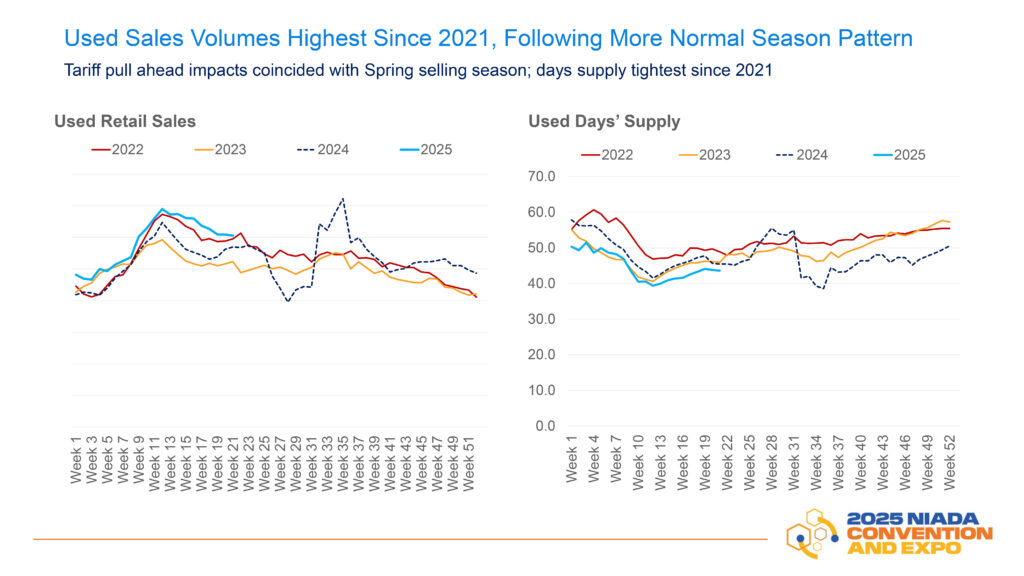

Through the first half of the year, used retail sales have stayed above recent years, including the previous peak of 2022. Sales have cooled since the spring.

Strand credited some of the strong spring sales numbers to the pull ahead of the projected tariffs on imported vehicles and parts expected to elevate prices.

Inventory remains tight at slightly above 40 days’ supply, the tightest since 2021.

“Since the pandemic, the market is about 8 million units undersupplied,” Strand said. “There’s a lot of people out there who want to trade out of a car and in this market would trade out of a 20-year-old car to a 14-year-old car.”

Due to the tight supply, older vehicles are being leaned on to fuel the market. Vehicles from nine to 12 years in age and 17 and older are growing in sales as newer vehicles have been in short supply. Strand pointed out that the average age for vehicles on the road is 12.8 years. He said the inventory challenges will linger and urged dealers to be creative in their sourcing for vehicles.

Used auto finance rates remain around 14 percent for consumers with monthly payments at $575, according to Cox Automotive data. With payments on student loans starting back after the hiatus during the pandemic, more consumers are slipping into the subprime range. The percentage of subprime consumers seeking used financing is at its highest point since mid-2020.

According to NIADA data from the first quarter presented by Carmichael, retail dealers have seen a 2.2 percent increase in gross per vehicle to $1,921. The F&I gross is up 17.1 percent or $225 to $1,525.

“The opportunities are there,” Carmichael said.

For BHPH dealers, reconditioning costs are up 8.9 percent to $1,440. The average charge-off is down 4.7 percent or $365 to $7,395.

“That’s a good sign. We’re getting a little better on the collection, and hopefully, underwriting is going to continue to improve,” Carmichael said.