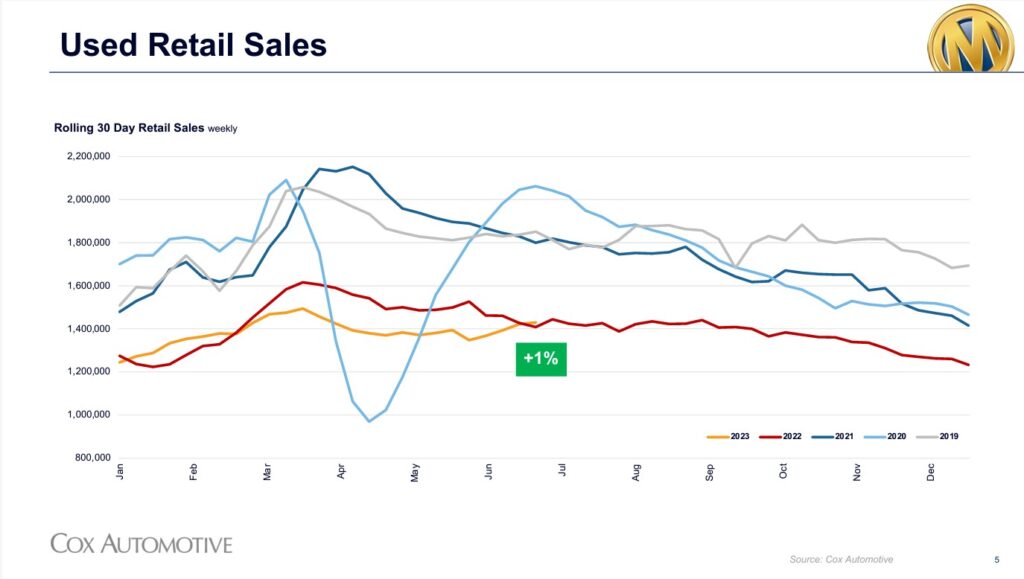

The retail used vehicle market received a boost to start July.

According to the mid-month Manheim Market Insights released by Cox Automotive, retail used vehicles sales were 1 percent ahead of July 2022 at more than 1.4 million.

“Used retail sales have shown some spark in recent weeks, after a relatively disappointing spring selling season. Early July retail sales of used vehicles jumped up above a year ago for the first time since early January,” said Chris Frey, Senior Manager, Economic and Industry Insights at Cox Automotive.

Frey did warn the recent boost is likely to be curtailed as the calendar moves to August.

“We believe the steadier prices and improving consumer sentiment has been a tailwind for retail sales of late,” Frey said. “However, new vehicle inventory continues to improve, which will likely put downward pressure on used retail sales during the second half of the year.”

Used retail prices remain steady, according to Manheim’s numbers. The average price has hovered around $27,000 since the start of May. It’s down 3 percent from last year.

“Used retail sales prices have remained remarkably steady through the first half of 2023,” Frey said. “Prices seem to be moving in a more normal pattern where there will be some softening in the second half of the year.”

The total supply of vehicles is at 2.22 million, up 18,000 in the first two weeks of July. Frey points out that is still 10 percent behind July 2022. The days of supply has remained around 47 days for several weeks.

“But it is down 11 percent compared to last year,” Frey said. “Overall the relatively tight inventory might suggest dealers would be more aggressive at wholesale to stock their lots, but we believe dealers are playing cautiously not wanting to get ahead of the market. We feel they have a good balance of supply to meet their current demand.”

The Manheim Used Vehicle Index continues to show a sharp decrease in wholesale prices, which are down 11.1 percent from July 2022. They are down 1 percent from June.

“We are expecting more normal depreciation trends reflective of retail demand improving, as wholesale declines make their way through the system and eventually become retail declines,” Frey reported.