Since opening the Mars Dealership in Dallas in 2021, George Khumarov has become increasingly aware of the buy-here, pay-here market.

“We started thinking about BHPH. A lot of leads are asking if we do in-house financing,” Khumarov said. “It’s made us understand it’s popular in this market with this price range.

We knew nothing about it…We decided to get information from the industry leaders.

George Khumarov, Mars Dealership

“We knew nothing about it…We decided to get information from the industry leaders.”

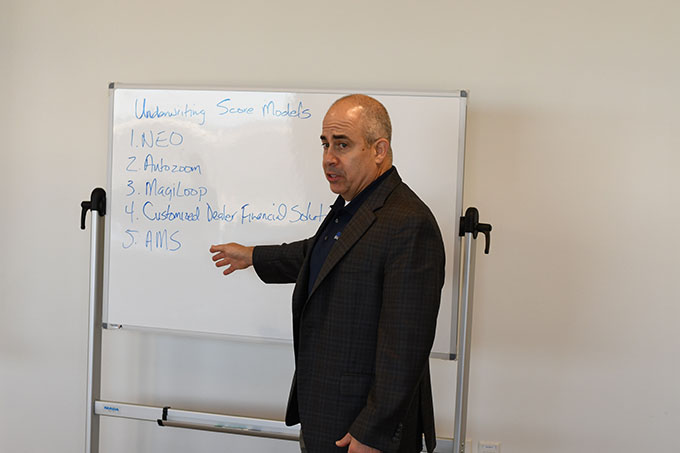

Khumarov attended the NIADA Buy-Here, Pay-Here New Dealer Academy Wednesday and Thursday to learn about the profitable segment of the used car market in Irving, Texas, from 20 Group Moderators Ben Goodman and Bill Elizondo. In two days, the industry veterans with more than 60 years of combined experience shared information about BHPH trends, reconditioning, collections, deal structure, inventory and underwriting.

“It’s been a high level bullet-point class, but hopefully you’ve taken a lot out of it,” Goodman said at the end of Thursday’s class. “It’s a lot of great information. It’s a great business. A lot of people are making money, and it’s a recession proof model.”

At the start of the two-day session, Goodman and Elizondo covered recent economic trends, pointing to growth in the BHPH segment.

According to data from Experian and the U.S. Bureau of Labor Statistics, bankruptcy petitions increased by 7 percent in September 2022. People seeking financial relief through restructuring debt are also increasing, after many of the stimulus programs during the COVID-19 economic recovery have expired.

“Filings are going up because people can’t afford payments,” Elizondo said.

Even as finances are tightening, the labor market remains strong. Unemployment is still at a 50-year low and people still need transportation to get to work. This is creating additional opportunities for BHPH dealers.

“This is the absolute best time to get into buy here-pay here,” Goodman said.

From the start, Goodman and Elizondo framed that this model is a finance and collections business, with the vehicle being the commodity.

“You’re selling a finance program. It’s designed to help the customer rebuild their credit,” Goodman said.

Many of the BHPH customers are in need of transportation, but have low credit scores and few options. This makes developing a relationship with the customer key, as you work to get them in a car they can afford.

“This is a relationship business. You want to make sure they are able to afford a vehicle and make payments,” Elizondo said.

To build this relationship, Goodman suggests working through underwriting and structuring a deal before putting the customer in a vehicle that fits their needs for a test drive.

Dealers must also make sure to get accurate information from the customer, which can be tricky. Due to their circumstances, many of the customers are conditioned to stretch the truth.

“At the end of the day, you want them to be honest with you. You tell them, you want to get all the information you can get to them approved today. Remind them, ‘I’m the finance guy.’”

Bill Elizondo, NIADA 20 Groups Moderator

“At the end of the day, you want them to be honest with you,” Elizondo said. “You tell them, you want to get all the information you can get to them approved today. Remind them, ‘I’m the finance guy.’”

Goodman and Elizondo also do not set up deals for customers living more than 50 miles from the dealership, due to service and repossession logistics.

“It’s too far out,” Goodman said. “It won’t be easy for service.”

Collections in BHPH is also a continuous conversation working with customers. Elizondo said at the end you can’t let collections become personal.

Goodman and Elizondo advised the class to set up payday payments. When the customer gets paid, they pay for their vehicle.

“At the end of the day, we tried to educate you on the business. There’s different ways to run a business, and we don’t always agree,” Elizondo said.

Khumarov, who is new to the model and a veteran Rosie Johnson, the Vice President of R&D Motors, who has been in the business for 28 years, each took many lessons from the two-day session.

I got a lot of new ideas to take back. I was able to take away something for every department.

Rosie Johnson, R&D Motors

“I got a lot of new ideas to take back. I was able to take away something for every department,” Johnson said. “Specifically with collections, we’ve been collecting monthly and we may switch to pay day.”

Khumarov added: “This was good training. It was good to have people with 30 years of experience teaching. It was very personalized. You were able to ask questions.”

NIADA has more BHPH training on tap soon. A BHPH collections workshop will be held via Zoom April 6. BHPH service management training in Dallas is April 12. On April 13 is the BHPH underwriting workshop online. The BHPH general management training is April 26.

Find the schedule and registration at niada.com/course-schedule.