Delinquencies on auto loans are on the rise with the escalating costs of inflation.

Experian’s fourth quarter market report found a rise in delinquencies year-over-year. The amount of 30-day delinquencies rose from 1.86 percent to 2.31 percent. The 60-day delinquencies increased from 0.66 percent to 0.87 percent.

In the current market, a strong underwriting process is critical for buy-here, pay-here or lease-here, pay-here businesses.

To help you develop a sound strategy for determining who to develop loans for, NIADA Senior 20 Group Moderator Bill Elizondo will lead a BHPH Underwriting Workshop April 13. The virtual workshop is 10 a.m. to 4 p.m., with a 30-minute lunch break. The cost is $395 for non-members. NIADA members and 20 Group members receive special pricing.

Elizondo has spent more than 30 years training and leading high-achieving sales teams, collections, and operations in the subprime and BHPH markets, including highly successful tenures with the nation’s largest publicly traded BHPH organization America’s Car-Mart and Superior Auto. His leadership and expert understanding of every BHPH discipline significantly improved operational performance at every stop.

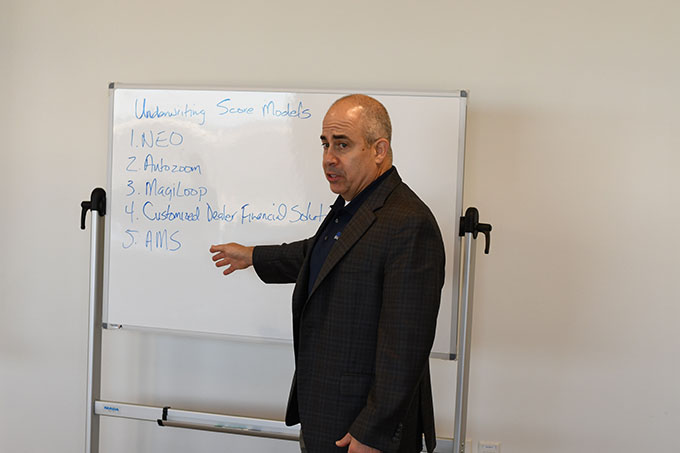

During the course, attendees will learn the three strengths of good underwriting, procedures for verifying customer information and consistent decision-making, how to analyze the ability of customers to pay based on accurate financial data, and leveraging underwriting scoring models to help make tough decisions.

Register for the class here.

See a list of NIADA courses at niada.com/course-schedule/.