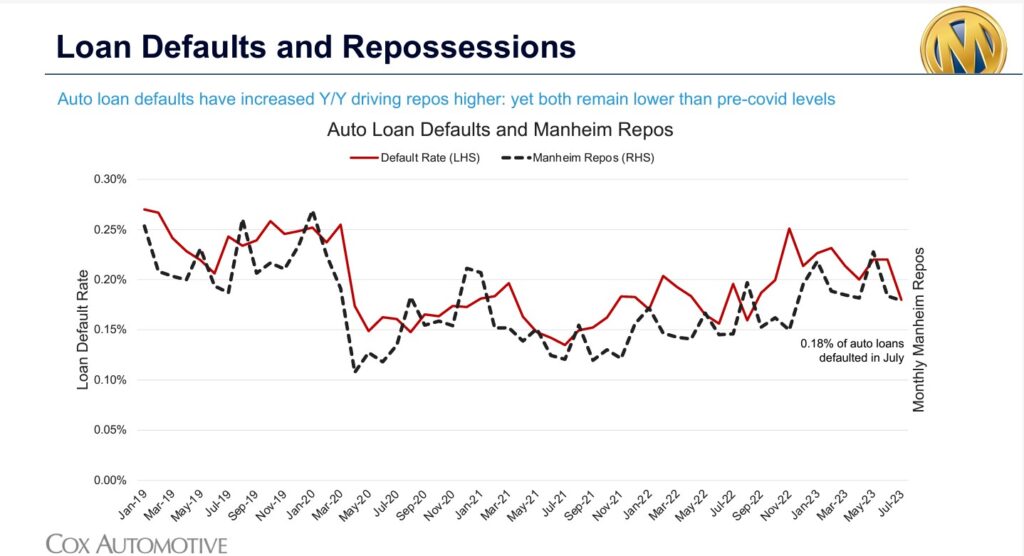

Auto loan defaults and repossessions are running higher than last year, according to data from Cox Automotive.

In July, 0.18 percent of all auto loans were in default. That was up about 0.03 percent from July 2022. It is down from March.

Jeremy Robb, senior director of economic and industry insights at Cox Automotive, points out that defaults are running well behind pre-pandemic levels. Defaults in March 2020 were above 0.25 percent. Manheim’s repossession rates were also above 0.25 percent in March 2020 and were at 0.18 percent in July.

“We’ve noted several times that repos are still down versus pre-pandemic levels and the same is true with defaults,” Robb said. “The credit quality of the overall loan portfolio is a bit better. Unemployment remains strong, and while delinquencies are higher, we just aren’t seeing as many consumer delinquencies turn into defaults.”

Robb did point out one change on the horizon, which could affect the number of delinquencies and defaults, as student loan deferments expire.

“This will be important to watch in the coming months as student loan repayments begin in September,” Robb said.

The impact of the student loan payments could also be felt with sales.

“This is likely to have an impact on consumer psychology and will be key to monitor this fall as millions of people begin to repay those loans,” Robb said. “It’s bound to have some type of impact on consumer behavior.”