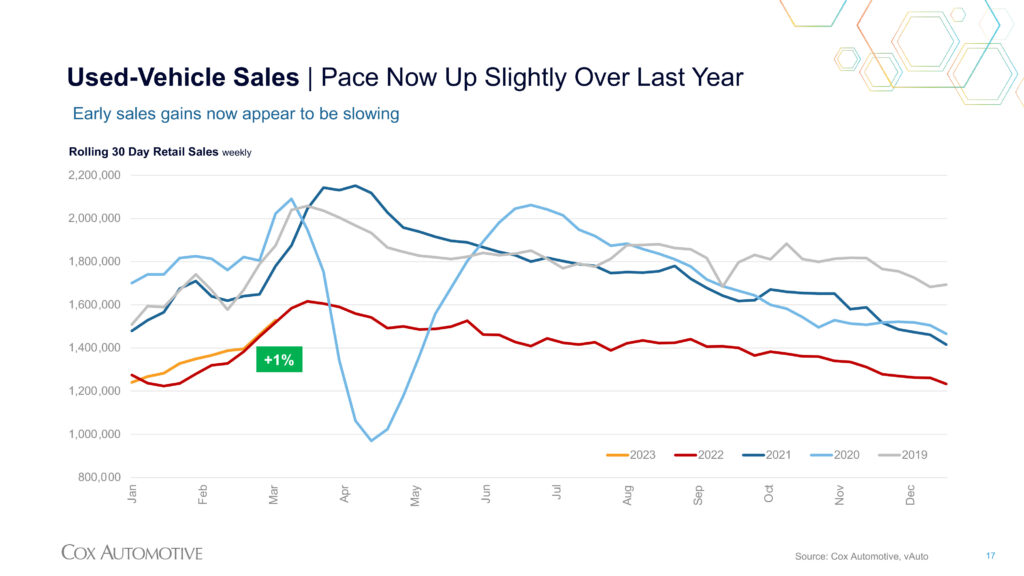

With used vehicle sales starting the year stronger than expected, annual forecasts are improving slightly.

Cox Automotive analysts increased their sales projections for 2023 for used vehicles and certified pre-owned vehicles, during Monday’s first quarter industry insights and sales forecast call.

Used retail sales were up 1 percent through March, with strong January and February sales, as vehicle prices began to fall. Vehicle prices are down 6 percent year over year to $25,856 — a decrease of $1,542. The average mileage increased from 70,824 a year ago to 71,191 this March.

“Things have changed quite a bit since December. We’ve had a surprisingly robust start to 2023 sales, with continued overall lower used prices (so far), and more money in the hands of consumers. With that in mind, we’ve adjusted the forecast to be 36.2 million for 2023, virtually flat from 2022. Interest rates will continue to present some difficulty for all consumers, especially for subprime and lower-income buyers.”

Chris Frey, Senior Manager, Economic and Industry Insights for Cox Automotive

“Things have changed quite a bit since December,” said Chris Frey, Senior Manager, Economic and Industry Insights for Cox Automotive. “We’ve had a surprisingly robust start to 2023 sales, with continued overall lower used prices (so far), and more money in the hands of consumers. With that in mind, we’ve adjusted the forecast to be 36.2 million for 2023, virtually flat from 2022. Interest rates will continue to present some difficulty for all consumers, especially for subprime and lower-income buyers.”

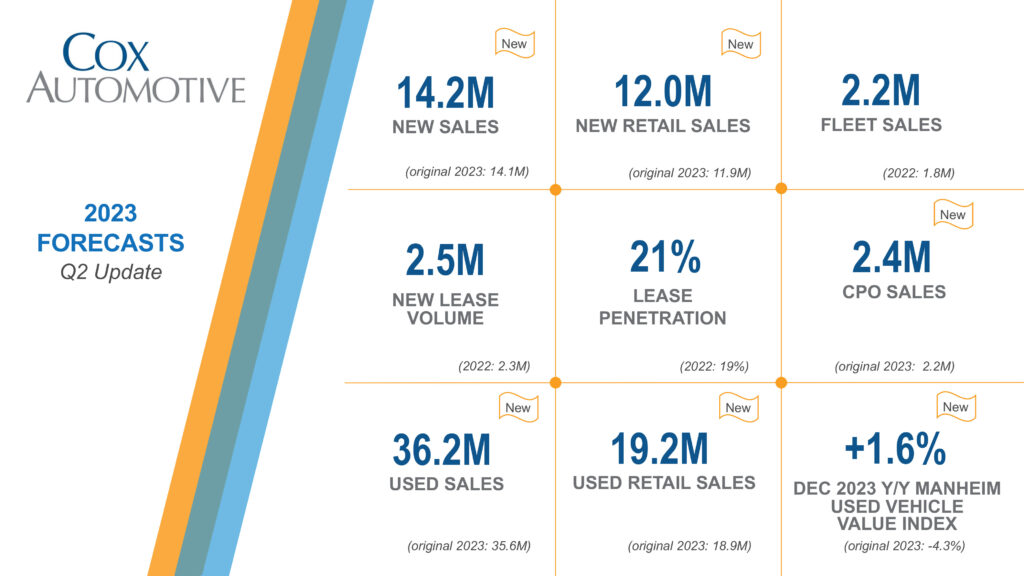

The annual used vehicle sales forecast bumped up from the previous projection of 35.6 million. Used retail sales also increased from a projected 18.9 million to 19.2 million.

“The used retail SAAR was revised to be slightly up, from 19.1 last year to 19.2 million in 2023, given the positives noted. The adjustments to our forecasts reflect optimism and no expectation of any major fallout resulting from further rate increases,” Frey said.

In spite of inventory challenges, CPO sales have started the year strong. CPO sales are up 14 percent year over year with more than 200,000 units sold in January and February.

“We’ve seen CPO start off well above 2022 levels just in the first 2 months, but without much visibility into the older certified units making it into the retail stream, our CPO forecast is down a bit to 2.43 million, from 2022’s 2.47 million,” Frey said.

“The lack of off-lease supply into the CPO pipeline has created some headwinds. Several OEMs have extended their criteria for certification, though the ages and mileage caps vary.”

Overall, used inventory is down 21 percent — 536,000 vehicles — from last year. The days of supply is down to 40.

The forecasts for new vehicle sales also increased slightly to 14.2 million. Monthly loan payments are up to $784 on average with transaction prices near $49,000.